Stop fraud, RATs, and malware with Intratel’s and Group-IB’s Fraud Protection AI. Our advanced behavioral analysis uses AI to detect and prevent threats in real-time, safeguarding your business and users.

Modern digital channels, exchange, and payment systems operate at lightning speed, 24/7/365, leaving almost no window for manual risk review or constant monitoring. As your network expands, cybercriminals are becoming increasingly tactful at convincing businesses and even security systems that they are legitimate.

What’s your solution to these convoluted techniques? Traditional fraud solutions? Inflexible and outdated approaches can put customers at serious risk as they fail to timely detect changes in account behaviors and capture key indicators of fraud.

Intratel’s and Group-IB’s Fraud Protection AI offers cutting-edge behavioral analysis to identify and stop these threats in their tracks. By tracking physical and digital user behaviors across web and mobile applications, our AI distinguishes between genuine users and cyber criminals with remarkable precision.

Benefits of Fraud Protection Behavioural Analysis

- Increased security: Proactive defenses against a wide array of fraud.

- Identification of suspicious activity: A nuanced understanding of fraud protection that distinguishes legitimate profiles from fraudsters.

- Improved user experience: Passive biometrics protect legitimate users without disruptions.

- Reduced financial losses: Prevention of fraud-related financial damage.

- Protection against unauthorized access: Safeguarding sensitive data and systems.

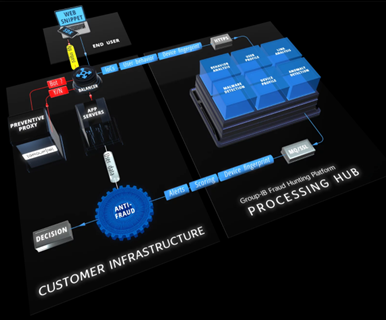

How Fraud Protection AI Works

Data Collection

Web users via a WebSnippet (JavaScript): This tool captures detailed information about how users interact with webpages. It records mouse movements, click patterns, and keystroke dynamics.

Mobile application users via Mobile SDK (Android & iOS): This tool collects extensive data from mobile devices using the Activity Collection Capability to capture screen clicks, view hierarchies, navigation patterns, and accessibility events, and the device Motion Collection Capability to gather insights from various device sensors.

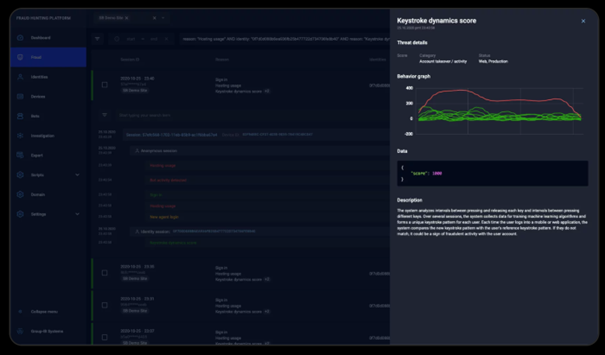

Baseline Behavior & Anomaly Detection

Building Individual & Median User Models:

A unique behavioral profile is established for each user, which includes their typical digital behavior, access patterns, and interaction patterns. Additionally, we create a median user model to represent the “normal” behavior across the user base.

Real-Time Monitoring & Risk Scoring:

We continuously monitor user actions and compare them against both individual and median models. If there are deviations, alerts are triggered, and a risk score is assigned based on the severity of the anomaly.

Advanced Detection Capabilities with Behavioural Analysis

Our AI analyzes an extensive range of behavioral indicators to identify various types of threats, including:

- Fraud: Account takeover attempts, suspicious payment activity, new account fraud, identity theft, promotion abuse, bot attacks, and more.

- RATs & Malware: Unauthorized remote access, unusual file activity, suspicious network behavior, unexplained system changes, and unexpected application installations.

- Specific Behavioral Anomalies: Signs of abnormal behavior that may include blocked screen resolutions, usage of automation tools, abnormal mouse movements, excessive page transitions, social engineering signs, suspicious clicks, and more.

- Device & Network Insights: Identifying new devices, foreign IPs, hosting subnets, known fraudster profiles, application similarities, and network anomalies.

Suspicious activities trigger fraud alerts, which are used to respond appropriately, such as automatically blocking transactions, requiring additional authentication, alerting fraud investigators, and quarantining devices.

Global ID is the technology leveraged by the Fraud Protection that marks devices and users across online resources around the world where Fraud Protection is running and allows to distinguish good and bad devices. In they particular case, having data on the fraudsters’ device, the Fraud Protection analysts established the connections with their two other devices and six new user accounts, that the attackers had logged into recently. All information received was promptly provided to the bank, which managed to block the accounts before the money was stolen. In the meantime, Group-IB Computer Emergency Response Team (CERT-GIB) took down the phishing website.